What Is Consumer Duty?

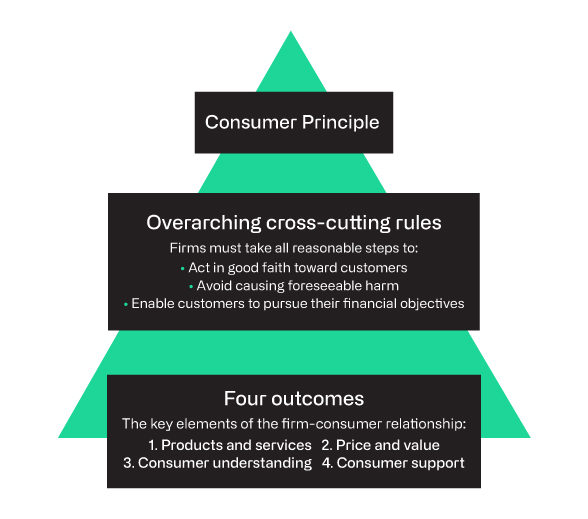

It’s a new set of standards created by the FCA to improve consumer protection and build more trust across the spectrum of financial services.

The Duty lays out an overriding Consumer Principle:

A firm must act to deliver good outcomes for retail clients.

And is supported by three cross-cutting rules and four customer outcomes.

Three cross-cutting rules

A firm must:

Act in good faith towards retail customers

Avoid causing foreseeable harm to retail customers

Enable and support retail customers to pursue their financial objectives

Four Consumer Outcomes

This outcome aims to ensure products are designed with a clear target market in mind and that the customer’s needs, characteristics, and objectives are documented.

This outcome aims to ensure customers pay a fair price for the product or service they receive and that the price paid is reasonable compared to the overall value and benefit they receive.

This outcome requires firms to provide clear information so customers can make informed decisions about financial products and services.

This outcome aims to ensure customers have sufficient support and information to meet their needs throughout their relationship with a firm.

FCA Guidance

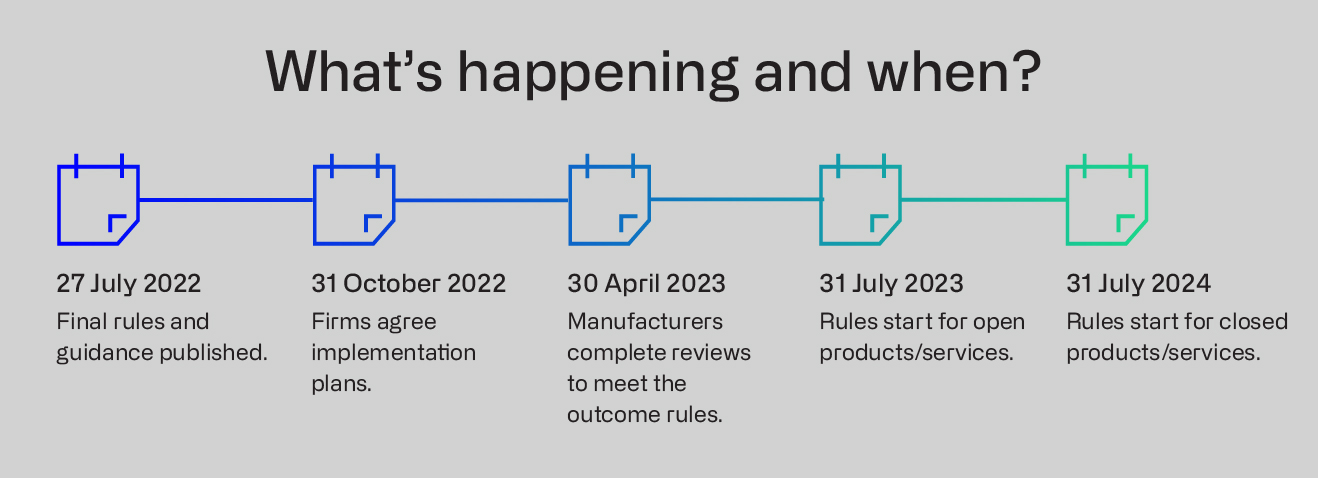

As a reminder, the FCA set out its policy statement and final rules for Consumer Duty in July 2022.

Download: Policy Statement on Consumer Duty

Download: Final guidance on Consumer Duty

Resources for you

Target Market Statements and Fair Value Assessments