07 Mar 2024

Using pensions for legacy planning

For professional advisors only

Tony Hicks | Head of Sales | Copia Capital Management

Inheritance tax receipts reached £6.3bn in the ten months from April 2023 to January 2024 according to the latest figures[i]. With the tax take already £400m more than the same period last year, it looks like HMRC is set for another record year for IHT.

However, this may just be the tip of the iceberg. Analysis by probate specialist Kings Court Trust estimates that over £5.5 trillion in intergenerational wealth transfers will take place within the next thirty years due to rising levels of wealth among the over 65s[ii]. While some commentators were predicting changes to IHT in the Spring Budget, the rumoured reductions to the tax didn’t materialise, meaning it’s an issue that’s likely to affect an increasing number of people.

Intergenerational wealth planning

Advisers have various options for helping clients mitigate IHT and pass on wealth to their loved ones tax efficiently. For those who do not need to use their full retirement savings to generate an income in later life, leaving a legacy via a pension could be an attractive option.

Almost all pensions sit outside the client’s estate for IHT purposes, but the tax rules vary depending on age at death. If a client dies before they are 75, benefits can be drawn by their beneficiaries – which can be anyone they nominate, not necessarily immediate family – tax-free. Over the age of 75, benefits are taxed at the beneficiaries’ marginal rate of income tax. As IHT currently stands at 40%, if the beneficiary is a basic rate taxpayer, they could potentially save 20% in tax by inheriting wealth via pension rather than from other assets held within the estate.

For clients who want to use their pension to leave a legacy as well as generate an income, then preserving and enhancing the capital value will be an important consideration. One way of doing this is by using a decumulation portfolio strategy that is purpose-built to work in conjunction with a guaranteed income solution. The guaranteed income asset is 100% uncorrelated to other asset classes and provides a guaranteed income for life (personalised to the investor). In doing so, it reduces the need to sell assets in unfavourable markets to generate income, providing investors in drawdown with some protection against the effects of sequencing risk. As more of the assets stay invested for longer, this increases the opportunity to outperform and leave a legacy, while staying within the same risk profile for the investor.

At the same time, given the constant and uncorrelated nature of the guaranteed income asset, this also means that some of the portfolio’s overall risk budget can be reallocated to the investment portion, with a weighting slightly more towards equity and alternatives, and slightly less towards traditional bonds. This again offers more opportunity for growth, potentially enhancing outcomes for a legacy pot, without increasing overall portfolio risk.

The regular income from the guaranteed income asset is paid within the SIPP tax wrapper and can be withdrawn as income or reinvested back into the accompanying MPS portfolio which can greatly enhance outcomes for the legacy pot.

Enhancing the legacy pot

Taking an example of this type of portfolio strategy in action, Copia Classic Retirement Income Plus (RI+) blends a guaranteed income asset provided by Just SLI, with an investment portfolio managed by Copia’s expert team.

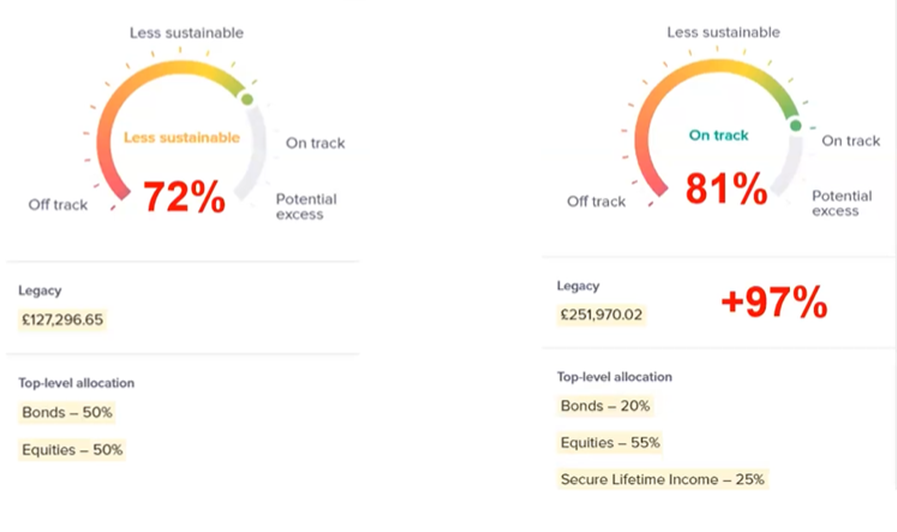

We put two theoretical £400,000 portfolios paying income of 4% to a client from age 70 to 97 through Timeline’s stochastic modelling functionality.

The first (on the left), with a traditional 50/50 equity bond split, has a 72% probability of success in sustaining that income for the full timeframe and leaves a legacy pot of £127,000 after 27 years.

The second portfolio (on the right) uses 25% of the portfolio to buy SLI, and the Copia team manages the asset allocation for the remaining portion of the portfolio with 20% to bonds and 55% to equities. The overall sustainability of the portfolio increases to 81%, while the legacy pot increases to nearly £252,000.

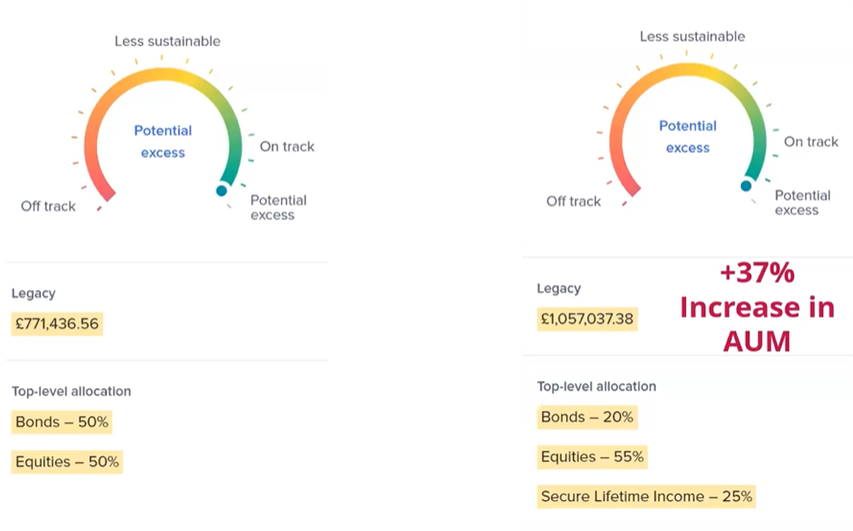

If you wanted to switch off the 4% income withdrawal altogether, reinvesting back into purpose-built MPS, using the same client and portfolio examples , the legacy pot on the 50/50 bond/equity portfolio is worth £771,000 after 27 years, while the legacy pot in the RI+ portfolio is worth over £1 million.

Pensions are an important part of intergenerational financial planning as clients increasingly want to protect their wealth to pass on to loved ones. Using guaranteed income assets alongside a managed investment portfolio can provide tax efficiency and protection from longevity and sequencing risk. At the same it delivers the flexibility to reinvest some or all of the income back into the investment portfolio, offering greater potential to grow the legacy pot.

Find out more

You can find more information about RI+ on our website, or speak to one of our Sales team about how we can help meet your clients’ investment needs.

We’ve recently launched our rethinking retirement roadshows. Book you spot now to join a CPD-accredited discussion on retirement planning now and in the years to come. I’ll be there alongside experts from the lang cat, Just and Wealthtime.

This article and our events are intended for professional advisers only. Not to be distributed to, nor relied on, by retail clients. Please remember that the value of investments and the income from them can fall as well as rise, and you may get back less than you invest. Tax treatment depends on individual circumstances and may be subject to change in the future.. Copia does not provide advice, advisers must seek their own compliance/legal advice before relying on the information provided in this article.

[i] https://www.gov.uk/government/statistics/hmrc-tax-and-nics-receipts-for-the-uk/hmrc-tax-receipts-and-national-insurance-contributions-for-the-uk-new-monthly-bulletin#inheritance-tax-iht

[ii] https://www.kctrust.co.uk/wealthtransfer