14 Jul 2023

Taking a scientific approach to managing risk

Robert Vaudry, Managing Director, Copia Capital

When it comes to managing investments for clients, our goal is usually to construct portfolios across the risk-return spectrum that generate real returns that outpace inflation for those in accumulation and deliver certainty of outcome for those in decumulation.

We believe that asset allocation, rather than stock selection, is the main driver in determining portfolio outcomes and performance. However, making informed asset allocation decisions is a complex task influenced by various factors. We not only have to take into account the client’s objectives, risk appetite and time horizon, but also need to consider the impact of market fluctuations and macroeconomic indicators, like equity and bond values, interest rates, inflation, unemployment rates, and commodity prices.

To navigate asset allocation decisions, investment managers need robust capital market assumptions for each asset class. However, although the data is available, it’s difficult, if not impossible, for human fund managers to fully understand and digest all the information to then align their portfolios to deliver optimal returns. Human decisions can also be susceptible to emotional and behavioural biases, which can negatively impact investment decisions.

At Copia, we take a robust scientific approach to investing, using a quantitative process that reduces manager risk and behavioural biases. There is clear evidence to support the view that there is a mathematical relationship between market and economic variables and asset class risk-return expectations. By using powerful technology to crunch all the available data, we can gain a much clearer view of the likely future economic outlook and position our portfolios accordingly to enhance risk-adjusted returns and deliver a smoother investment journey while mitigating downside risk.

Optimising asset allocation

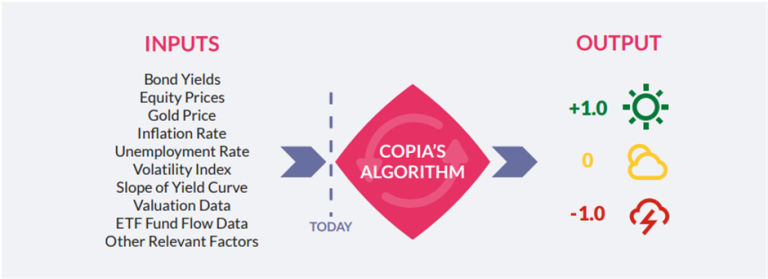

Our proprietary Quant Model is a key part of our investment methodology. Scanning hundreds of market and economic variables, including equity prices, bond yields, interest rates and the gold price, it estimates the expected risk and return for different asset classes.

The predictive output from the Quant Model is then plugged into our unique Risk Barometer to generate a risk score of between +1.0 and -1.0, which informs our tactical asset allocation and provides a systematic approach to dynamic risk management. The Risk Barometer uses a red, amber and green system to show the level of risk, with green (risk scores between +1.0 and 0.33) indicating that global economic signals are more positive than negative and red (-0.33 to -1.0) the opposite, while amber (0.32 to -0.32) suggests the outlook is more balanced.

For instance, a score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. During these periods, the Risk Barometer tilts our portfolios towards riskier assets.

A score of 0 indicates a neutral economic outlook with an almost equal probability of positive and negative returns in risky asset classes like equities. Here the Risk Barometer maintains a balance between asset classes.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. In these periods, the Risk Barometer tilts our portfolios away from riskier assets.

By leveraging tactical asset allocations based on our Risk Barometer, we ensure a systematic and evidence-driven approach to risk management. We can fully understand the potential impacts of market fluctuations and macroeconomic conditions to carefully balance the risks against potential rewards. The Risk Barometer adds an additional layer of protection for clients, tilting portfolios towards safer asset classes during periods of uncertainty to further reduce client exposure to riskier investments.

At the time of writing, the Risk Barometer reading stood at -0.73 (as at 31 May 2023), indicating that the global economic outlook remains negative. The score highlights the negative signals from Government bond markets, with major global yield curves remaining heavily inverted (where longer-term bonds show a lower return than short-term bonds), an increasingly negative outlook for equities and widening credit spreads driven by persistent inflation and central bank interest rate raising activity. As a result, we’re cautious of the overall health of markets and currently remain globally diversified, while taking advantage of opportunities in select sectors of the market.

We believe that by taking a scientific approach to risk management using technology-backed, quant-driven tactical asset allocation tilts, we can protect portfolios from short-term market risk, delivering enhanced returns for clients, with less volatility and reduced downside risk.