24 Oct 2024

DFM Agreements: Agent as Client or Agent of Client?

Tony Hicks, Head of Sales, Copia Capital

For professional advisers only

Last month I talked about the benefits of co-manufacturing as a way to de-risk your investment management proposition. Alongside the co-manufacturing decision, when you’re outsourcing to a DFM, you also need to consider the basis of the agreement – whether it is Agent of Client (also known as Reliance on Others) or Agent as Client.

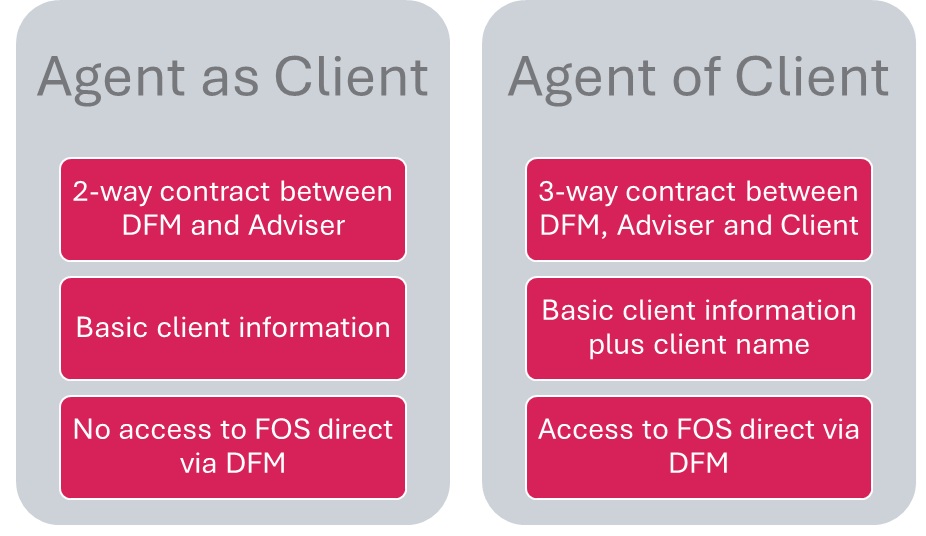

Both types of arrangements work for advisers and clients, but there are clear differences between the two. The choice has implications on the disclosure of client information required under the Consumer Duty rules and the responsibilities of the adviser firm, so it is important to have a robust agreement in place that clearly sets out the responsibilities of each party.

Agent as Client

Agent as Client tends to be the most common type of agreement when working with a DFM and Copia’s off-the-shelf portfolios are managed on this basis. Here the adviser is classed as the client of the DFM and the contractual relationship is between the DFM and the adviser firm. For all regulatory and communications purposes, the adviser firm is the DFM’s client and makes suitable investment decisions on the client’s behalf. For Agent as Client agreements, we require four pieces of basic client information from the adviser firm: risk profile, objective, capacity for loss and understanding.

There is no direct contractual relationship between the DFM and the client, but there must, of course, be a separate agreement between the adviser firm and the client. This must give the adviser firm the specific authority to set the investment mandate and appoint a DFM on the client’s behalf. When operating under an Agent as Client agreement, your client contract must detail the full scope of your authority. Acting outside of the agreed scope could result in both the DFM and the client having a claim against you.

If for any reason the client wants to seek redress from the Financial Ombudsman Service (FOS), they would do so via the adviser firm, there is no direct route via the DFM as there is no direct contractual relationship.

It’s also important to note that the DFM is required to categorise the adviser firm as the client and, as an authorised person, you may be deemed as a ‘per se professional client’. This classification could lead to being invested in products which are unsuitable for retail clients and may not be appropriate for the end client. At Copia, we treat all actual and potential investor clients as retail customers.

Agent of Client

Under Agent of Client, which is also referred to as Reliance on Others, both the adviser firm and the investor client have a direct relationship with the DFM through a three-way, or tripartite, contractual relationship. The adviser firm is responsible for defining the target market and assessing suitability, and the DFM for building and managing the portfolios. The DFM and the adviser firm are both responsible for ensuring fair value and have a regulatory duty of care to the investor client.

In addition to the information provided under the Agent as Client agreement, with Agent of Client, the adviser must also provide the client’s name. With Copia’s Agent of Client agreements, no other contact details are required, so while we are responsible for reporting on the portfolios to the advice firm, the responsibility for reporting to the client remains with the adviser firm.

If they have reason to complain to FOS, Agent of Client offers the additional benefit of the client being able to bring a case directly against the DFM.

Copia’s Custom portfolios can be managed on an Agent of Client or Agent as Client basis depending on how you prefer to work. The latter requires a side letter to our main Custom terms of business.

Importance of agreements

Both types of arrangements work for advisers and clients, so it’s up to you to choose which fits best with your business. Consumer Duty hasn’t changed these agreements, but as with many things, it has placed more emphasis on defining and documenting responsibilities and ensuring that the client fully understands the relationship with the DFM and what authority, if any, the adviser firm has to act on their behalf.

Clearly setting out the responsibilities of the DFM, adviser and client, including specifying who to refer to in the event of a complaint, simplifies the outsourcing of your investment management, helping to manage risk and meet regulatory requirements. By having well-defined contractual agreements in place, you can ensure a smooth, transparent DFM relationship that prioritises and protects the best interests of your clients.

Please remember that the value of investments and the income from them can fall as well as rise, and you may get back less than you invest. Tax treatment depends on individual circumstances and may be subject to change in the future.