02 Oct 2025

Bridging the pension’s trust gap

Toby Larkman, Managing Director, Wealthtime

For many people, retirement seems so far removed from their daily life that it often gets pushed to the bottom of the to-do list. But with an evolving pensions landscape, shifting demographics and mounting financial pressures, encouraging conversations about long-term finances has never been more important.

Understanding where we stand on retirement planning, how far we have come, and how to address the gaps that remain, is vital to effectively supporting people’s financial security.

The FCA’s Financial Lives Survey 2024 shows real progress, with a significant shift in pension provision in recent years. Three-quarters (75%) of respondents, which equates to almost 41 million adults across the whole UK population, now have some form of private pension, up from 65% in 2017. However, there’s more work to do. Almost one in five (17% or 9 million adults) don’t have any private pension provision. The remaining 8% (over 4 million people) don’t know, which is a worrying statistic in itself – if people aren’t sure if they have a pension, how can they be confident about their retirement future?

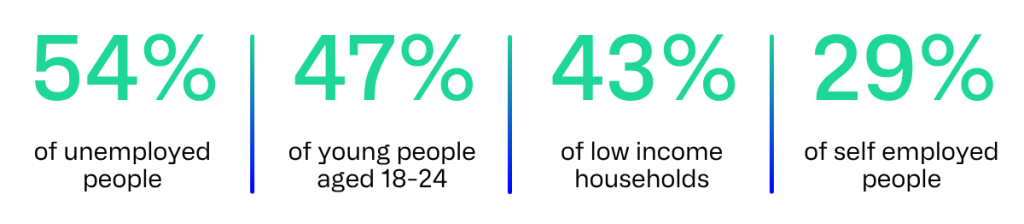

While the overall number of people without pension provision has decreased by 13 percentage points since 2017, several groups are still disproportionately affected, including the unemployed (54%), young people aged 18-24 (47%), low-income households (43%), and those who are self-employed (29%).

People without pension provision in disproportionately affected groups:

The trust problem

So what are the barriers to pension savings? Focusing on those aged 50 and over, the latest survey reveals that the two top reasons for not having private pension provision were not being able to afford to pay into a pension (33%) and feeling that it’s too late to start (33%). However, 9% said they prefer other ways of saving and 5% do not trust pension providers. Unfortunately, this anti-pension sentiment is growing, with respondents choosing those answers increasing from 8% and 4% respectively in 2022.

When those with DC pensions in accumulation were asked specifically to rank the level of trust they had in their pension provider from 0 to 10, a third (33%) reported low levels (0-6), while a further one in three (29%) said moderate (7-8). Satisfaction with providers was similarly weak, with 35% saying it was low and 28% moderate. Just one in five (19% and 17% respectively) said high (9-10), while the same proportion (19% and 20%) didn’t know – unsurprising as one in three (29%) couldn’t name their provider.

And these consumer misgivings reach beyond pension providers. A quarter (24%) of those who had not received regulated financial advice in the past 12 months said they distrust financial advisers, believing they do not act in the best interests of clients. A further two-fifths (39%) felt advisers were not unbiased, and 21% did not see them as professionals in the same way as solicitors and accountants.

Advisers are uniquely placed to help clients cut through complexity, weigh their options, and make informed choices that will shape their financial futures.

Toby Larkman, Managing Director

Perhaps more positively for advisers, the Financial Lives Survey found that the majority of respondents had little faith that computers would be able to help with decisions about their finances. Over three-quarters (77%) had low trust in automated computer decision-making for financial advice, including 24% with no trust at all, while just 3% had high trust. Women, those 55 and over and people with a household income below £50k were most likely not to trust it.

Yet the need for support around these long-term financial decisions is growing. Three fifths (60%) of DC pension holders aged 45+ believe that their DC pension(s) alone would not be enough to live on in retirement, while 12% of retirees said they have had difficulties paying for day-to-day expenses since they retired. One in ten (9%) of retirees strongly agreed they worry about not having enough money to last through retirement. These are exactly the type of concerns that working with a financial adviser can address.

The advice gap

The FCA research highlights the clear need for wider access to advice. It found that one in three (29%) of UK adults had not received regulated financial advice in the previous 12 months, despite potentially needing support. The regulator defined those in possible need of support as individuals with investible assets of £10,000 or more, and/or those with DC pension savings of at least £10,000 that they plan to access, or who intend to retire, within the next two years.

The research reveals gaps across all levels of investible assets. Even among those with over £250,000, 66% may need support. If, as an industry, we can engage more people earlier, we’ll help more clients achieve financial security in retirement.

These insights reinforce the importance of initiatives like Pensions Awareness Week in rebuilding trust in the sector and increasing understanding of retirement planning through information and education to ensure people can make the right decisions about their later life finances.

Advisers are uniquely placed to help clients cut through complexity, weigh their options, and make informed choices that will shape their financial futures. Pensions Awareness Week is a timely reminder of the profession’s role in strengthening trust in pensions and supporting long-term financial planning through meaningful conversations, education, and a commitment to act in the client’s best interests.

Get in touch with us

Speak to an expert member of the Wealthtime team to learn more about our award-winning SIPP.

Contact usStay connected

This article is intended for regulated financial advisers and investment professionals only. Wealthtime does not provide financial advice. This information is not intended as financial advice and should not be interpreted as such.